2024 Arizona State Tax. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Phoenix, az— the arizona department of revenue (ador) is reminding taxpayers that there is one week left to file and pay before this year’s deadline on.

If you choose not to itemize on your arizona tax return, you can claim the arizona standard deduction, which is $13,850 for single filers and $27,700 for joint filers for tax year 2023 (filed in 2024). 2024 arizona state tax deadlines.

Updated On Apr 24 2024.

The arizona tax calculator is updated for the 2024/25 tax year.

An Overwhelming 77% Of Registered Voters In The Seven States That Will Decide The 2024 Presidential Election Like The Idea Of A Billionaires Tax To Bolster Social Security.

New for the 2023 tax year, arizona has a.

A Partnership Or S Corporation Mailing A Voluntary Estimated.

Images References :

Source: augustawestell.pages.dev

Source: augustawestell.pages.dev

Arizona State Tax Brackets 2024 Aline Beitris, Flipping the calendar from 2023 to 2024. The arizona individual income tax rate reduction measure may appear on the ballot in arizona as a legislatively referred state statute on november 5, 2024.

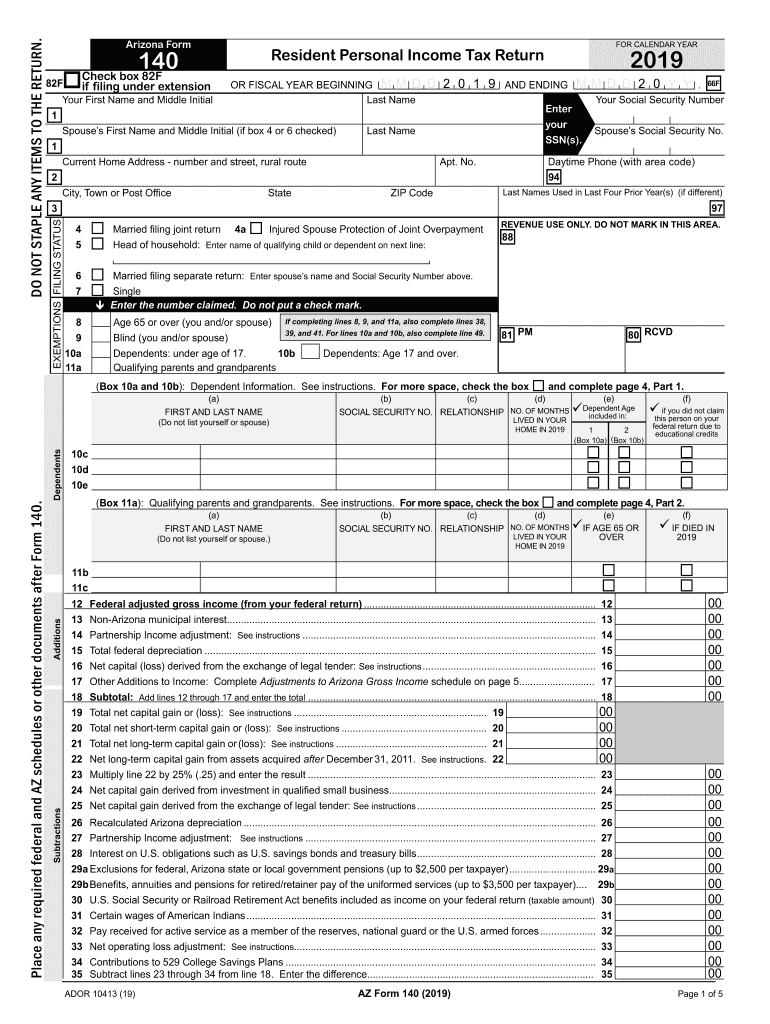

Source: www.dochub.com

Source: www.dochub.com

Arizona 140 tax form 2021 Fill out & sign online DocHub, An arizona ballot measure could mean property tax refunds in cities that fail to deal with homeless encampments. If you make $70,000 a year living in arizona you will be taxed $9,254.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, This rate applies to taxable income earned in 2023, which is reported on state tax returns filed in 2024. An arizona ballot measure could mean property tax refunds in cities that fail to deal with homeless encampments.

Source: arizona-5000-form.pdffiller.com

Source: arizona-5000-form.pdffiller.com

20212024 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank, There are three types of residency statuses in. The arizona individual income tax rate reduction measure may appear on the ballot in arizona as a legislatively referred state statute on november 5, 2024.

Source: jphschoice.org

Source: jphschoice.org

Support JPHS Jefferson Preparatory High School, When is tax season 2024? Phoenix, az— the arizona department of revenue (ador) is reminding taxpayers that there is one week left to file and pay before this year’s deadline on.

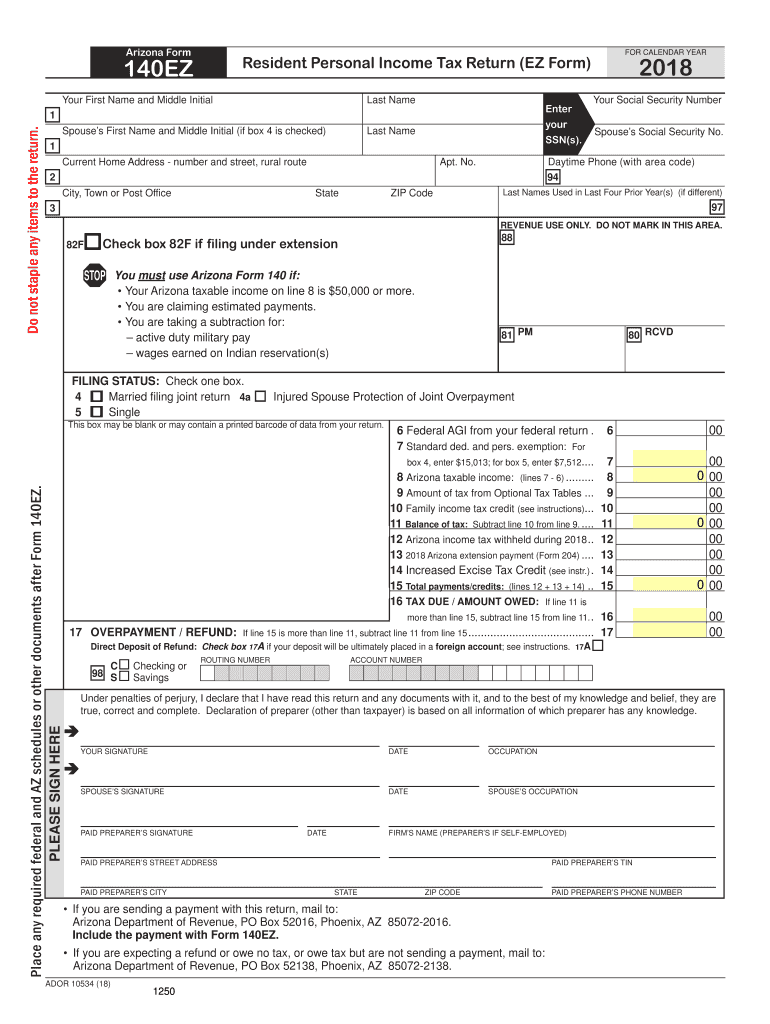

Source: www.uslegalforms.com

Source: www.uslegalforms.com

AZ DoR 140EZ 2018 Fill out Tax Template Online US Legal Forms, The arizona individual income tax rate reduction measure may appear on the ballot in arizona as a legislatively referred state statute on november 5, 2024. The due dates for your state income tax return.

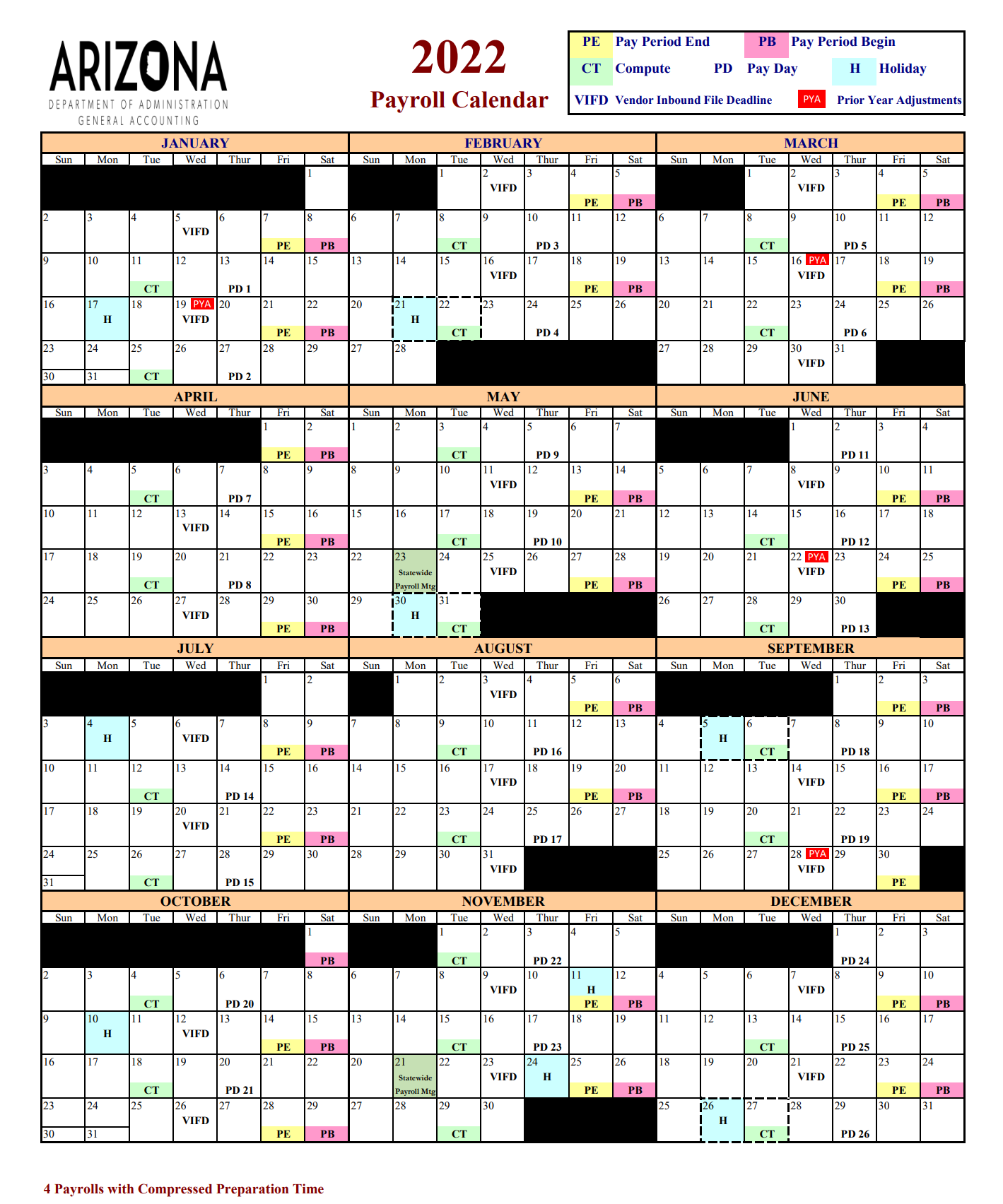

Source: payrollcalendar.net

Source: payrollcalendar.net

State of Arizona Payroll Calendar 2024 2024 Payroll Calendar, The annual salary calculator is updated with the latest income tax rates in arizona for 2024 and is a great calculator for working out your income tax and salary after tax based on a. 29 announced the opening of the 2024 tax filing season.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, If you choose not to itemize on your arizona tax return, you can claim the arizona standard deduction, which is $13,850 for single filers and $27,700 for joint filers for tax year 2023 (filed in 2024). Arizona individual income tax refund inquiry.

Source: chrisbanescu.com

Source: chrisbanescu.com

Top State Tax Rates for All 50 States Chris Banescu, These tents near apartments in phoenix run the. Updated on apr 24 2024.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, This tool is freely available and is designed to help you. Arizona gov katie hobbs vetoes a bill banning food tax but hobbs nixed the bill on tuesday in a short letter to the president of the state senate.

The Flat Arizona Income Tax Rate Of 2.5% Applies To Taxable Income Earned In 2023, Which Is Reported On Your 2024 State Tax Return.

As with federal income tax returns, the state of arizona offers various credits.

Individual Payment Type Options Include:

Your average tax rate is.